We yesterday received an email from someone responding to our general perspective on China. While the email addressed most of the factors we already recognized, it did so with a different spin – one that is much more supportive of China and much more fearsome of the future of the US.

Yes – there are plenty of commentators with a similar message, but likely few that are as well-reasoned and thoroughly conveyed. Nevertheless, one item stood out; that is the fact that America must recognize what made it the great nation it became ... and then get back to that. That that was “hard work and thrift.”

There are notable signs that we’re working on the thrift part of the equation ... and while there’s plenty of hard work happening still, it’s unfortunately hard to find work right now. An article in The Wall Street Journal today reveals new data on business cash piling:

Rather than pouring their money into building plants or hiring workers, nonfinancial companies in the U.S. were sitting on $1.93 trillion in cash and other liquid assets at the end of September, up from $1.8 trillion at the end of June, the Federal Reserve said Thursday. Cash accounted for 7.4% of the companies' total assets—the largest share since 1959.

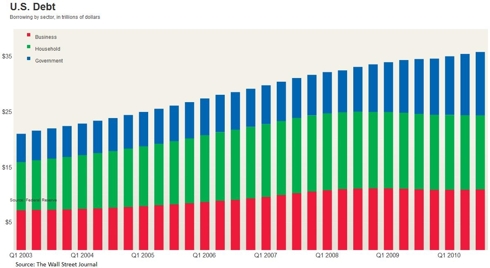

Among the biggest reasons for sitting on cash: the consumer is still not in a place where he can spend much. The Wall Street Journal has also put together a very nice series of charts explaining the financial situation in the US. To summarize: households are working to pay down debt, government debt is rising quickly, household net worth is still trying to fight back from its 2008 plunge, asset markets have helped compensate for the negative wealth effect of flat-lined home values, consumer credit (while improving) remains stubbornly high.

We keep hearing the same argument for fiscal spending in a recession; here is the latest version:

“ ... our “fiscal space” is limited – we cannot afford to blithely increase our national debt. It can be done – and should be done given the parlous state of our economy and our disastrously high unemployment levels. But it must be done carefully, so we get as much stimulative effect on jobs as possible for our debt-increase dollars.”

But what is interesting to us is that even going back to growth times in 2004 and 2005 the trajectory of government debt accumulation has not changed. It begs the question: how long do we wait before making meaningful slashes at public debt? Here is one of the charts as can be found in the above link from The Wall Street Journal:

So our corporations have become thrifty, our consumers are working on it (the attitude change appears to be there), but our government is not (or cannot yet become, if you’d prefer) more thrifty. What many will agree on, though, is that growth, domestically and globally, still very much hinges on the US consumer and, of course, China.

The latest trade data between the US and China was reported today. The US deficit narrowed by 13% from September to October; China’s surplus shrank by 16% from the October to November. On a head-to-head basis, US exports to China grew while Chinese exports to the US fell.

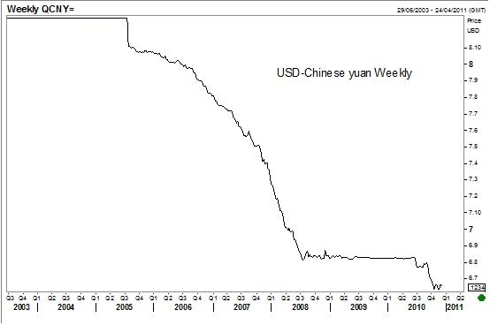

So let’s revisit the Chinese yuan revaluation theme ...

The media has seized on the undervalued yuan as a key piece of the recently popularized “currency wars.” A yuan that is suppressed lower gives competitive advantages to Chinese producers, pricing out other producers/exporters. Make sense? Good.

We recently read an argument that a yuan revaluation would be a negative for the US. This goes against common knowledge and political posturing in the US that is inching nearer the need for imposing trade restrictions on China if they don’t change their tune.

On Monday, 31 U.S. senators sent a letter to Wang Qishan, China's vice premier, urging him to solve several trade issues at the upcoming meeting. The senators said they want to discuss intellectual property disputes, "discriminatory innovation practices" and barriers to U.S. beef exports, reaching solutions ahead of an important visit from Chinese President Hu Jintao in January. (CNNMoney.com)

Indeed, it is our belief that a stronger yuan can help to alleviate some imbalances in China’s economy and in those of its major trading partners.

There were several assumptions made in the argument. One was that China would need to simultaneously strengthen its domestic demand. Yes. Another was that a stronger yuan would mean US imports from China become more costly for US consumers. Likely true.

But it was an assumption that it seems was not made, and one other that was, that could make the difference.

First, the un-assumed part, US consumer attitudes have changed ... or may even still be changing. The nature of this recession, how it begun with major erosion in net worth and culminated in lofty unemployment, has been a wake-up call for many Americans.

Second, perhaps incorrectly assumed: US consumers depend on Chinese imports, i.e. much of what the US imports from China is non-discretionary. Here is the breakdown of US imports from China in 2009, from The US-China Business Council:

Table 3: Top US Imports from China 2009 ($ billion)

*Calculated by USCBC

Source: US International Trade Commission

Source: US International Trade Commission

HS#

Commodity description

Volume

% change over 2008

85

Electrical machinery and equipment

72.9

-9.2

84

Power generation equipment

62.4

-4.2

61, 62

Apparel

*24.3

*1.5

95

Toys and games

23.2

-14.6

94

Furniture

16.0

-17.4

72, 73

Iron and steel

*8.0

*45.9

64

Footwear and parts thereof

13.3

-7.9

39

Plastics and articles thereof

8.0

-10.1

42

Leather and travel goods

6.0

-18.9

90

Optics and medical equipment

5.6

-9.4

Indeed, the top two items make up nearly 60% of Chinese import volume to the US. And on the face of it, those two items don’t appear too discretionary. Meaning: businesses dependent upon these capital goods and equipment might have little choice but to suffer through rising costs stemming from a stronger yuan. But here are some things to keep in mind:

1) As the cost of imports from China grows, production of the same items in the US becomes more feasible and the benefits of domestic production are felt throughout the US economy.

2) Businesses in the US are responding to the consumer and are sitting on cash, choosing not to invest in capital goods until improvement on the consumer front.

3) We will likely see further declines in volumes of the more discretionary imports from China until the US consumer recovers.

The way the aforementioned argument was presented China would be forcing a painful adjustment on the US via a yuan revaluation. But does the US consumer not still hold the key? If Americans don’t start buying again, and businesses don’t start investing in capital goods (from China), then who is really forced to accept painful adjustment?

Current account surplus countries must accept greater domestic adjustment in a world of slower demand and global rebalancing.

Hard work and thrift is a gratifying goal for the US.

China has paid lip-service to growing its domestic demand; though some statistics show real progress has been made. Instead of using their banks as conduits to funnel consumer savings to state owned enterprises, banks could start paying a more realistic rate on Chinese consumer deposits; that would be a good start. But something China is extremely reluctant to do given the composition of Chinese GDP is still heavy on the side of exports and investment. This is part of that domestic adjustment they must make—someday. They had better get cracking on empowering the Chinese consumer before the yuan issue gets nasty.

China has paid lip-service to growing its domestic demand; though some statistics show real progress has been made. Instead of using their banks as conduits to funnel consumer savings to state owned enterprises, banks could start paying a more realistic rate on Chinese consumer deposits; that would be a good start. But something China is extremely reluctant to do given the composition of Chinese GDP is still heavy on the side of exports and investment. This is part of that domestic adjustment they must make—someday. They had better get cracking on empowering the Chinese consumer before the yuan issue gets nasty.

http://www.blackswantrading.com/

No comments:

Post a Comment